Bryn Goodman is a principal and Traci Krasne and Nicole E. Price are associates in the New York City office of the national employment law firm Jackson Lewis P.C.

Whether managing employees who are traveling or those who regularly work remotely, it is important for employers to remain keenly aware of the legal pitfalls triggered by such arrangements.

Bryn Goodman

Permission granted by Bryn Goodman

To mitigate risk, employers must proactively ensure compliance with a complex web of federal, state and local laws. Below are five considerations for employers with remote employees.

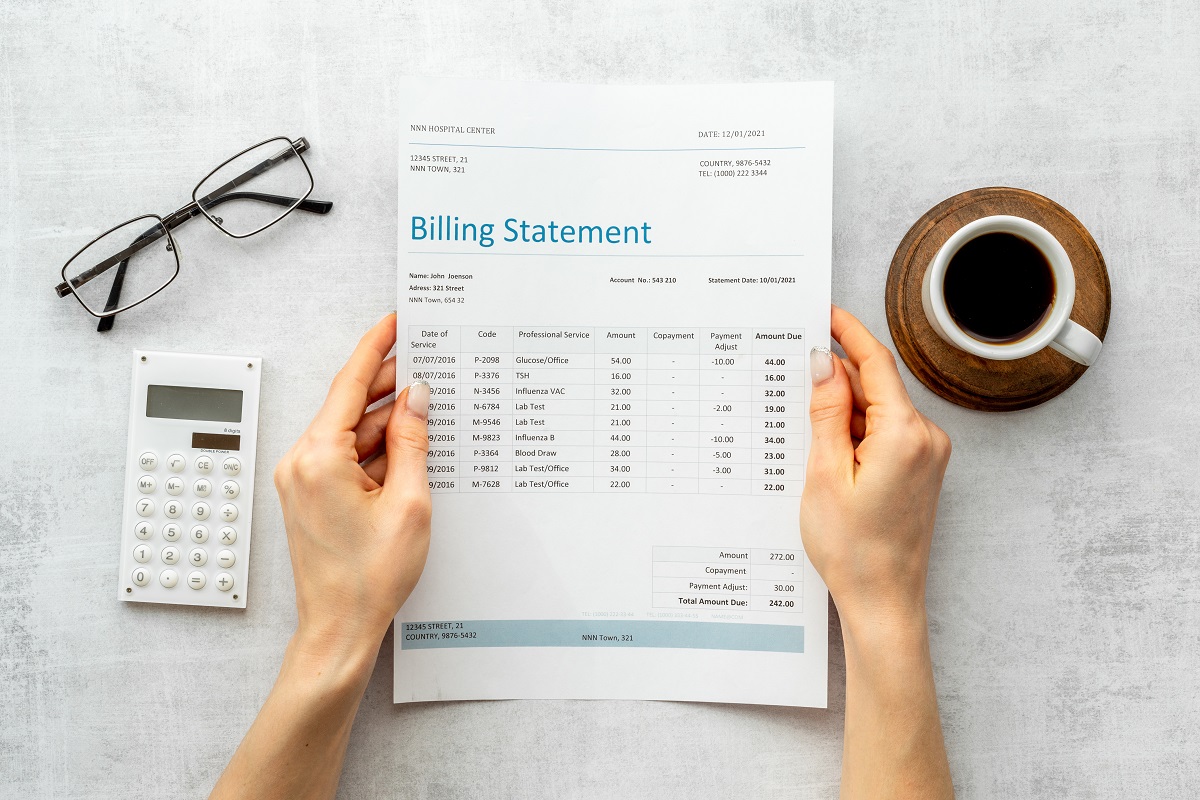

What are reimbursable business-related expenses for remote workers?

Employers need to be aware of where their employees are working remotely (even if the arrangement is temporary) and ensure they understand and comply with their obligations under federal, state and local law to provide reimbursements for business-related expenses.

Traci Krasne

Permission granted by Traci Krasne

The Fair Labor Standards Act requires employers to reimburse employees for remote work-related expenses if those costs would reduce an employee’s earnings below the federal minimum wage or applicable overtime rates, even if the remote work arrangement is short-term or temporary.

In recent years, some states have enacted laws mandating reimbursements for necessary business expenses. These states include California, Illinois, Iowa, Massachusetts, Minnesota, Montana, New Hampshire, North Dakota and South Dakota — with specific considerations applicable in California and Illinois even if there were no direct out of pocket business expenses. Seattle has also adopted a similar requirement.

Nicole Price

Permission granted by Nicole Price

These laws typically require employers to reimburse employees for business-related expenses incurred for an employee to work remotely, such as internet access, phone usage and office supplies. It is important to check the specific rules of the jurisdiction where the employee is working. For example, employers operating in California, Illinois and Seattle are required to prorate expense reimbursements when personal items or services — such as cell phones, vehicles or internet — are used for both business and personal purposes, ensuring that employees are compensated for the portion attributable to work-related use.

In addition, an employer’s obligations could vary depending on whether remote work is voluntary (if the employer maintains a physical office but the employee chooses to work remotely) or mandatory (if the business is entirely remote). Nevertheless, the savings on rent for office space will be offset by remote employees’ business-related expenses. Employers should maintain business expenses and remote work policies that consider the laws of the employee’s working location.

What are HR leaders’ obligations to track remote work hours?

As is the case with all employees covered by the FLSA’s overtime requirements, employers need to ensure they maintain effective procedures to accurately track and record nonexempt employees’ work hours. Indeed, even an employee’s voluntary decision to respond to work emails or perform other work outside of regular business hours must be recorded and compensated.

Employers have implemented various solutions to address this challenge but need to continuously review such solutions for compliance with evolving law. Some employers, for instance, have turned to software tools or programs, which can implicate privacy laws that could restrict the ability to use those tools. Employers also often set standard hours of operation in a designated time zone to ensure employees understand the parameters of companywide working time even while remote. Additionally, employers may wish to restrict email access on cell phones.

These practices must take into consideration the laws of the jurisdictions where employees work and should be in a written policy. Employers should also ensure their policies are consistently enforced.

What are employers’ tax withholding and reporting obligations for remote workers?

Remote employees are generally subject to the state and local laws where they physically work, not where the employer is based.

State income tax withholding could be triggered with only 14 days of work in certain states. Employers should monitor the threshold taxation requirements where remote employees are based, even if the company has no physical presence there. In certain circumstances, employers may need to withhold income taxes for two or more states.

Employers must also consider the impact on unemployment insurance and other payroll taxes, which may differ between the employee’s remote work location and the company’s location. If an employer fails to pay unemployment insurance payroll tax where a remote worker is based, it could trigger the state’s department of labor to conduct an audit of the company.

How does workers’ compensation insurance apply in the remote work context?

Similarly perplexing is the obligation to maintain workers’ compensation coverage in certain work locations. Although there are no specific regulations for home offices, employers generally are responsible for providing a safe work environment.

State workers’ compensation laws where the remote employee is working would also apply. An injury is typically covered by workers’ compensation insurance if it is work related. Without a defined remote workspace or work hours, it may be difficult to determine that an injury is work related.

Additionally, employers must keep records of work-related injuries, even if they occur while the employee is working remotely at home or while traveling. Employers should ensure their workers’ compensation insurance policies cover employees who are working remotely and temporarily traveling for work. Failure to maintain proper workers’ compensation insurance coverage can result in an employer being banned from operating in that state.

Are there data security and privacy regulations that apply to remote workers?

Federal, state and international data security and privacy laws often apply to remote workers. Federal regulations require employers to safeguard the personal information of employees, customers and clients, and certain U.S. states and Europe impose additional requirements.

For example, California’s comprehensive privacy laws require transparency in data collection and usage. Other states have employee electronic monitoring restrictions.

Employers must ensure that remote work practices comply with data security and privacy requirements imposed by the various laws. Employers that decide to monitor remote work to ensure security and compliance with their policies must balance surveillance and protection of data with employees’ rights to privacy.

Takeaways

Businesses should implement clear and comprehensive remote work policies that apply to all employees, including those working remotely on a temporary basis.

These policies should address, among other things, eligibility, approval, timekeeping, location changes, expense reimbursement and data security requirements.